Platform solutions

Building a common infrastructure for our industry

The lack of a common investment infrastructure and standards can result in inefficiencies. Our platform solution standardises and centralises many investment operations.

This reduces the cost and effort needed to create investment solutions whilst increasing the transparency investors demand. Here’s how we can help:

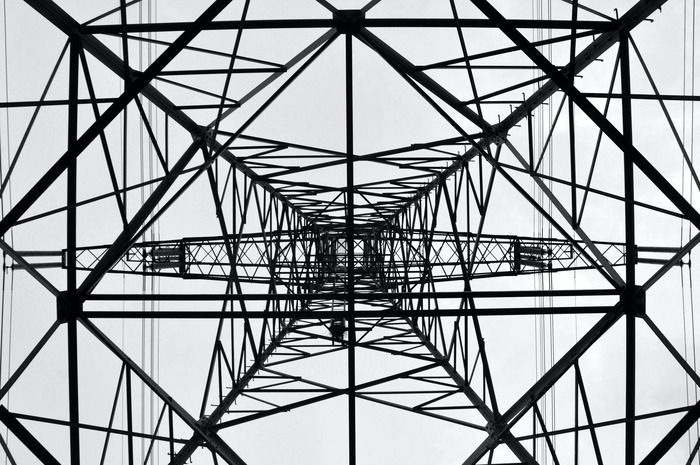

Photo by Erik van Dijk on Unsplash

Streamlined reporting

We streamline fund reporting so that investors receive consistent data and report formats across their whole AMX portfolio.

Regulatory responsibility

We take on regulatory oversight for all AMX fund structures, which reduces the governance burden for asset managers. Asset managers can also benefit from AMX’s fully resourced management company to manage and passport Irish-domiciled funds.

Pooled asset structure

Our pooled asset structure reduces the operational due diligence overhead for managers, as all fund assets from both big and small investors are serviced through a single AMX point of contact. This structure also enables smaller investors to invest with asset managers which may otherwise have been inaccessible to them due to a lack of scale.

Standardised documentation

We’ve standardised documentation across each product range to make redemptions, subscriptions and due diligence more streamlined. This reduces the legal costs usually associated with reviewing these documents.

Irish-domiciled fund structures

Institutional investors access AMX by investing in one or more of our Irish-domiciled fund structures. We offer both Common Contractual Funds (CCFs) and Irish Collective Asset-management Vehicles (ICAVs). Each fund structure contains multiple funds, which are managed by an individual asset manager to a specific investment strategy. This means institutional investors can make their own investment choices, using any combination of funds to achieve their investment objectives.

Tax transparent solutions

Historically, CCFs have been costly and complex to set-up. This has led to many pension schemes investing in global equities through tax-inefficient fund structures. This is an unnecessary drag on performance. Our platform infrastructure enables us to easily support managers to offer their strategies through a tax transparent CCF.